Top Car Insurance Plans

- CASHLESS GARAGES 8000+

- CLAIMS SETTLED 100%

- ZERO DEP. CLAIMS UNLIMITED

Maximum Cashless Garages

Over Night Vehicle Repairs

24x7 Roadside Assistance

Quick Claim Settlement

- CASHLESS GARAGES 3,100

- CLAIMS SETTLED 95%

- COMPREHENSIVE CLAIMS UNLIMITED

Towing Assistance (For Accidents)

Coverage Outside India

PSU Provider

Quick Claim Settlement

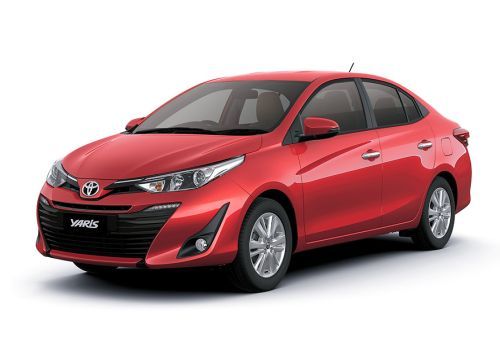

Toyota Yaris Variants with Insurance Premium Price

| Variant Name | Ex-showroom Price | Comprehensive Car Insurance | Third Party Car Insurance | Own Damage Car Insurance | |

Toyota Yaris Petrol | ₹7.00 Lac | ₹ 15426 | ₹ 3416 | ₹ 3778 | |

Toyota Yaris J Optional BSIV 1496 cc, Petrol | ₹8.76 Lac | ₹ 15426 | ₹ 3416 | ₹ 3778 | |

Toyota Yaris J Optional 1496 cc, Petrol | ₹8.76 Lac | ₹ 15426 | ₹ 3416 | ₹ 3778 | |

Toyota Yaris J 1496 cc, Petrol | ₹9.40 Lac | ₹ 15426 | ₹ 3416 | ₹ 4921 | |

Toyota Yaris J BSIV 1496 cc, Petrol | ₹9.40 Lac | ₹ 15426 | ₹ 3416 | ₹ 4921 | |

Toyota Yaris J Optional CVT BSIV 1496 cc, Petrol | ₹9.46 Lac | ₹ 14770 | ₹ 3416 | ₹ 4083 | |

Toyota Yaris J Optional CVT 1496 cc, Petrol | ₹9.46 Lac | ₹ 14770 | ₹ 3416 | ₹ 4083 | |

Toyota Yaris G Optional 1496 cc, Petrol | ₹9.74 Lac | ₹ 15418 | ₹ 3416 | ₹ 4205 | |

Toyota Yaris G Optional BSIV 1496 cc, Petrol | ₹9.74 Lac | ₹ 15418 | ₹ 3416 | ₹ 4205 | |

Toyota Yaris J CVT BSIV 1496 cc, Petrol | ₹10.10 Lac | ₹ 15728 | ₹ 3416 | ₹ 5226 | |

Toyota Yaris J CVT 1496 cc, Petrol | ₹10.10 Lac | ₹ 15728 | ₹ 3416 | ₹ 5226 | |

Toyota Yaris G BSIV 1496 cc, Petrol | ₹10.55 Lac | ₹ 15715 | ₹ 3416 | ₹ 5213 | |

Toyota Yaris G 1496 cc, Petrol | ₹10.55 Lac | ₹ 15715 | ₹ 3416 | ₹ 5213 | |

Toyota Yaris G Optional CVT 1496 cc, Petrol | ₹10.94 Lac | ₹ 14898 | ₹ 3416 | ₹ 4729 | |

Toyota Yaris G Optional CVT BSIV 1496 cc, Petrol | ₹10.94 Lac | ₹ 14898 | ₹ 3416 | ₹ 4729 | |

Toyota Yaris V 1496 cc, Petrol | ₹11.74 Lac | ₹ 15754 | ₹ 3416 | ₹ 5165 | |

Toyota Yaris V BSIV 1496 cc, Petrol | ₹11.74 Lac | ₹ 15754 | ₹ 3416 | ₹ 5165 | |

Toyota Yaris G CVT BSIV 1496 cc, Petrol | ₹11.75 Lac | ₹ 16235 | ₹ 3416 | ₹ 5736 | |

Toyota Yaris G CVT 1496 cc, Petrol | ₹11.75 Lac | ₹ 16235 | ₹ 3416 | ₹ 5736 | |

Toyota Yaris V Optional 1496 cc, Petrol | ₹12.08 Lac | ₹ 15863 | ₹ 3416 | ₹ 4770 | |

Toyota Yaris V Optional BSIV 1496 cc, Petrol | ₹12.08 Lac | ₹ 15863 | ₹ 3416 | ₹ 4770 | |

Toyota Yaris V CVT BSIV 1496 cc, Petrol | ₹12.94 Lac | ₹ 16274 | ₹ 3416 | ₹ 5597 | |

Toyota Yaris V CVT 1496 cc, Petrol | ₹12.94 Lac | ₹ 16274 | ₹ 3416 | ₹ 5597 | |

Toyota Yaris VX 1496 cc, Petrol | ₹12.96 Lac | ₹ 16282 | ₹ 3416 | ₹ 5697 | |

Toyota Yaris VX BSIV 1496 cc, Petrol | ₹12.96 Lac | ₹ 16282 | ₹ 3416 | ₹ 5697 | |

Toyota Yaris V Optional CVT 1496 cc, Petrol | ₹13.28 Lac | ₹ 16382 | ₹ 3416 | ₹ 5597 | |

Toyota Yaris V Optional CVT BSIV 1496 cc, Petrol | ₹13.28 Lac | ₹ 16382 | ₹ 3416 | ₹ 5597 | |

Toyota Yaris VX CVT 1496 cc, Petrol | ₹14.18 Lac | ₹ 16282 | ₹ 3416 | ₹ 6369 | |

Toyota Yaris VX CVT BSIV 1496 cc, Petrol | ₹14.18 Lac | ₹ 16282 | ₹ 3416 | ₹ 6369 |

Calculate Your Toyota Yaris Insurance Price

Select your car brand

- Maruti

- Hyundai

- Honda

- Toyota

- Mahindra

Which city is your car registered in?

- Ahmedabad

- Bangalore

- Chandigarh

- Chennai

When did you buy your car?

Toyota Yaris Key Specifications

Price ₹8.76 Lakhs onwards | |

Mileage 17.1 to 17.8 kmpl | |

Transmission Manual, Automatic | |

Engine 1496 cc | |

Fuel Type Petrol | |

Seating Capacity 5 Seater | |

Power 105.5 BHP | |

Torque 140 NM |

Add-ons For Your Toyota Yaris Car Insurance

Find Right Car Insurance Quotes by Cars Body Type

Calculate your Car IDV

Partner Car Insurance Companies

Explore Car Insurance

Toyota Yaris Car Insurance User Reviews

47 Reviews

Car Insurance For Popular Toyota Cars

Toyota Yaris FAQ's

- 1

Which insurer has the best claim settlement ratio for Toyota Yaris cars

Bharti AXA General Insurance, Acko General Insurance, and ICICI Lombard General Insurance are among the car insurers with great claim settlement ratio for Toyota Yaris cars.

- 2

From where can I purchase insurance for my Toyota Yaris car

You can compare car insurance policies offered by all the top-rated insurers in India for Toyota Yaris at InsuranceDekho and choose the plan which best suits your needs. With InsuranceDekho, you can purchase an insurance policy in just 5 minutes

- 3

Which are the insurance add-ons for Toyota Yaris cars

The most opted insurance add-ons with Toyota Yaris cars include RSA (Road Side Assistance) cover, zero depreciation add-on, NCB (No Claim Bonus) cover and engine cover among others.

- 4

What all documents do I need to get my Toyota Yaris car insurance renewed?

You can get your Toyota Yaris car insurance policy renewed paperlessly with InsuranceDekho. You just need to have the following details with you:

1 Previous Year Policy Number

2 Previous Year Policy Expiry Date

3 Vehicle Registration Number